It’s imperative that you have a transparent comprehension of how you’re gonna use the money you obtain from the business loan. Financial institutions aren’t considering lending to businesses with only obscure notions of how the Doing the job funds is going to be put to operate.

Unlike a lot of regular lenders, Countrywide Funding delivers tailored financing remedies on your business. We make an effort to speak to you and get to understand you, as an alternative to only taking a look at your monetary background or credit history score. Our approach causes it to be simple to obtain the funding your business has to retain going forward.

This web site is often a cost-free on-line resource that strives to offer practical content and comparison capabilities to our people. We take advertising payment from firms that show up on the website, which can affect the location and get where brand names (and/or their goods) are offered, and will also effects the score that is definitely assigned to it.

Evaluating your choices is The obvious way to ensure you’re receiving the best small business loan for your business. Think about the next aspects when figuring out which loan is best for your needs:

You should maintain your personal credit rating rating around snuff, as the more recent your business along with the smaller your revenues, the more lenders will analyze your personal funds.

Acquiring a business loan for small business Functioning cash may be harder than getting funding for other applications. Business loans symbolize a giant danger to lenders due to the volatility of The patron industry.

On February fifteenth, the U.S. Small Business Administration released a final rule to undertake the current statutory choice dimensions conventional for its seven(a) and 504 loan packages, issue to an adjustment for inflation which includes occurred Considering that the establishment on the statutory alternative dimension standard in 2010.

It’s not unusual to need a business loan to protect charges you could’t cope with with all your current Performing funds. Seasons and circumstances modify, impacting everyday income movement plus your capacity to aid continued progress.

If you're just getting started, there are lots of main reasons why you could would like to make an application for a business loan. Loans present dollars for:

Loan ensures are what give personal lenders The arrogance to supply SBAs with decrease payments and even more adaptable terms.

As a result of time and expenditure concerned, think about no matter whether you truly need a small business loan and 504 SBA loan Reno when your organization will gain from the Functioning funds prior to implementing, as well as what your other funding selections are.

The ones that demand more quickly use of funds can make an application for an Convey SBA loan, which cuts down acceptance the perfect time to 36 several hours, and provides dollars to the borrower’s bank account inside a make any difference of months.

We are not an expense adviser, loan supplier, or even a broker and we do not offer loans or mortgages straight to conclusion end users, but only permits customers to match with lending companions and platforms which will lengthen a loan. All loan approval selections and conditions are based on the loan providers at enough time of your application with them.

The adjustment enhances the agreement limit to $nine million plus the agreement Restrict for Federal contracts, if a federal contracting officer certifies that such a warranty is critical, to $fourteen million.

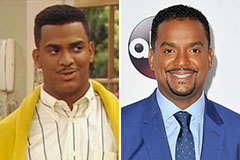

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Shane West Then & Now!

Shane West Then & Now!